While consumer confidence is at the highest level this year, we recommend investors take a cautious approach when considering adding risk to diversified portfolios.

The CCI increased to 117.0 in July, up from 109.7 in June and reaching levels not seen since July 2021. A reading above 100 means consumers are more optimistic than the benchmark CCI of 100, established in 1985. The strong reading highlights the resilience of both businesses and consumers in the current economic cycle, pushing back against the narrative of an impending recession.

When analyzing the CCI further, it appears the rise in expectations was widespread across current and future conditions. The Present Situation Index—a sub-component of the CCI, which is based on consumers’ assessment of current business and labor market conditions—rose to 160.0, up from 155.3 last month. Another sub-component of the CCI, the Expectation Index—which is based on consumers’ short-term outlook for income, business, and labor market conditions—increased to 88.3, up from 79.3 in June. Notably, Expectations rose above 80 – the level that has historically signaled a potential recession in the next year.

While expectations have risen considerably from a year ago (July 2022’s reading was 95.3), the exuberance is not shared across age groups. Consumers under the age of 35 have the brightest outlook for business and labor conditions, with the CCI for the under 35 cohort at 135.6, hovering around pre-pandemic levels. The under 35 cohort differs considerably from those 55 and over, with the CCI reading for this age group at 106.6, below pre-pandemic levels of roughly 120.

Spending habits among the two cohorts also differs considerably, as the younger demographic tends to spend more on rent, mortgage interest, jewelry, and infant accessories, while the older demographic spends more on financial services, entertainment, food at home, and prescription drugs.

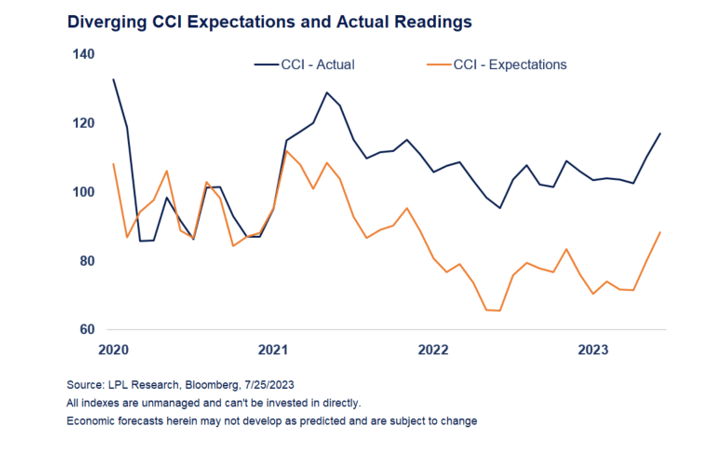

It is also worth noting the differing trajectories of expected CCI versus actual CCI over the last few years. In the below chart, you’ll see the expected and actual CCI move nearly in lockstep between mid-2020 and early 2021. The divergence occurs at the end of the first quarter of 2021, where expected CCI decreases, following a string of rising expectations. Actual CCI continues to increase into the end of the second quarter of 2021, creating a 20 point gap between actual and expected. Today, the gap stands at 29, further highlighting the differing views between actual and expected confidence.

As mentioned earlier, a CCI reading below 80 indicates a potential recession in the next year. In the chart above, expected consumer confidence has been below 80 in 14 out of the last 16 months, suggesting an economic slowdown in the near future. In contrast, actual consumer confidence has come below 100 only twice in the last 16 months, which would suggest a more positive outlook for the economy. The conflicting signals lead us to believe a mild and short recession is the most likely scenario in the future, potentially over the next 6 to 9 months.

Amid the uncertainties of a potential recession, the LPL Research Strategic and Tactical Asset Allocation Committee (STAAC) has become increasingly positive on core bonds, as the equity-risk premium (as measured by the S&P 500 earnings yield minus the U.S. 10-year Treasury yield) no longer favors stocks over bonds. In addition, bonds have historically generated above-average returns after the end of Federal Reserve rate hiking cycles. In a multi-asset portfolio, we recommend maintaining a neutral position on equities, coupled with a slight overweight to fixed income and underweight to cash.