First, to our clients who work in the federal government, we recognize this shutdown creates real uncertainty and hardship. Please know we are thinking of you and encourage you to reach out if you have any concerns about your financial situation.

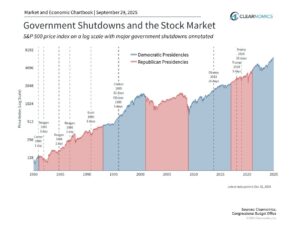

The federal government entered a shutdown after lawmakers were unable to reach a funding agreement. While this has immediate effects on federal workers and government services, history shows shutdowns have had little lasting impact on financial markets. Even the longest on record, the 35-day shutdown in 2018 and 2019, created only temporary disruptions rather than long-term challenges for economic growth.

The current situation reflects disagreements over spending priorities, primarily related to healthcare. While funding the government is the immediate focus, these debates highlight deeper differences over the role of government and long-term fiscal responsibility. With federal debt now around 120% of GDP, there is broad recognition that discipline is needed, but there is little consensus on how it should be achieved.

As an aside, the shutdown also halts the release of key government reports, including the monthly jobs numbers and inflation data. This leaves investors relying more on private-sector sources such as ADP’s employment report, which is especially important given recent questions around the strength of the labor market.

Markets may react to the uncertainty in the near term, but history suggests shutdowns do not alter the fundamentals that drive long-term returns. For investors, the takeaway remains to stay focused on financial plans rather than political headlines.

Important Disclosures:

The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Indexes are unmanaged and cannot be invested in directly.